Compensation Discussion and Analysis

Executive Summary

This Compensation Discussion and Analysis provides an overview and analysis of (i) the elements comprising our compensation program for our named executive officers, who we refer to in this Compensation Discussion and Analysis as our NEOs; (ii) the material 20222023 compensation decisions made under that program and reflected in the executive compensation tables that follow this Compensation Discussion and Analysis; and (iii) the material factors considered in making those decisions.

For the year ended December 31, 2022,2023, our NEOs were:

David S. Graziosi, Chairman,Chair, President and Chief Executive Officer;

G. Frederick Bohley, Senior Vice President, Chief Financial Officer and Treasurer;

John M. Coll, Senior Vice President, Global Marketing, Sales and Service;

Eric C. Scroggins, Vice President, General Counsel and Secretary; and

Teresa J. van Niekerk, Vice President, Global Purchasing and Supplier Quality.Chief Procurement Officer.

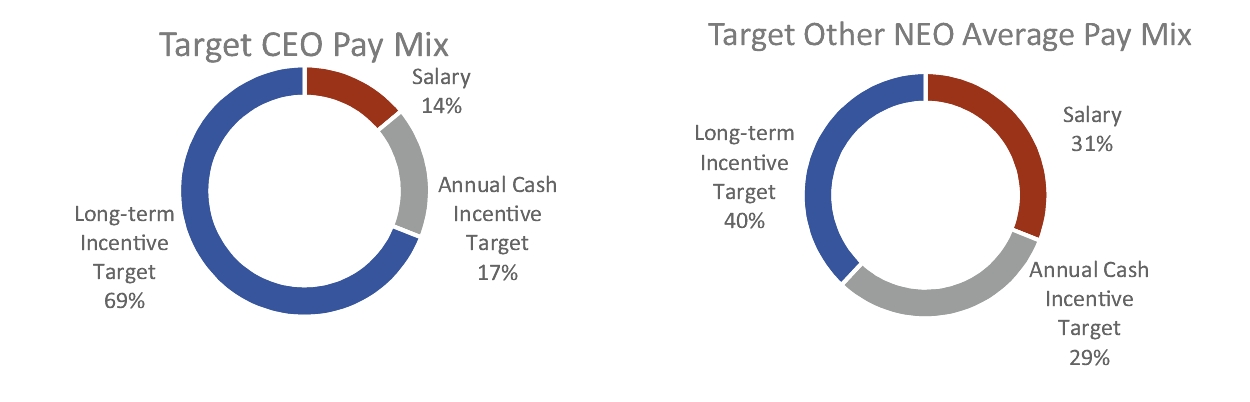

We intend to provide our NEOs with compensation that is largely performance based. Our executive compensation program is designed to align executive pay with our performance on both short-term and long-term bases, link executive pay to specific, measurable results intended to create value for stockholders, and utilize compensation as a tool to assist us in attracting and retaining the high-caliber executives that we believe are critical to our long-term success.

20222023 Business Results and Implications for Compensation.2022 was a notable year for our growth objectives, despite continued volatility During 2023, Allison accomplished the following:

achieved Revenue of $3,035 million, experiencing gains in every end market other than the commercial vehicle industry and considerable labor, supply chain, transportation and raw material constraints. Notwithstanding these challenges, Allison was able to:

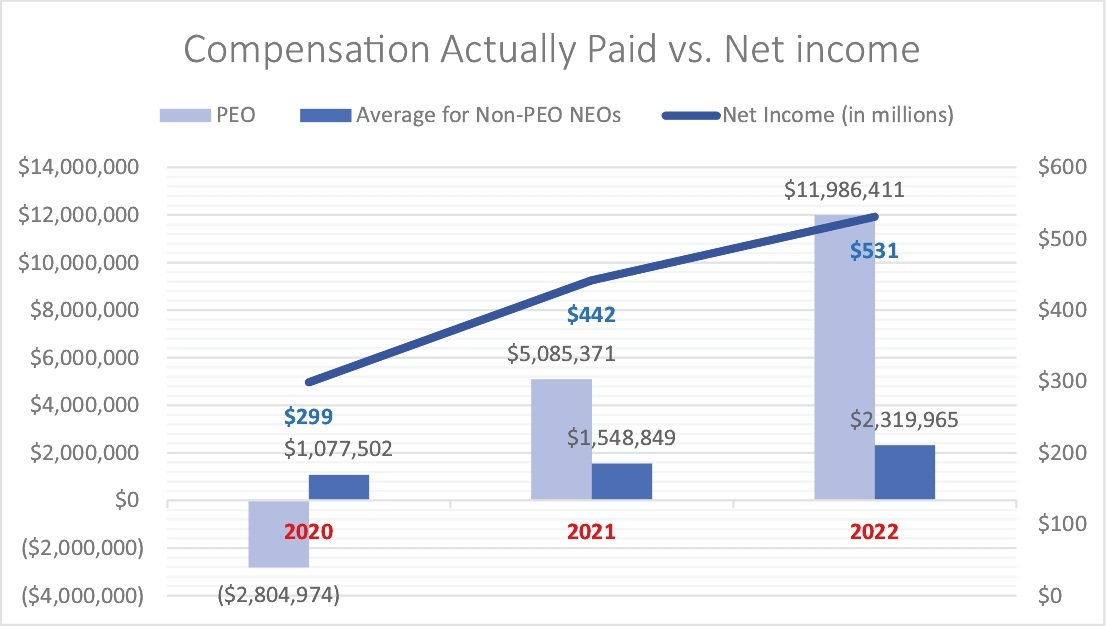

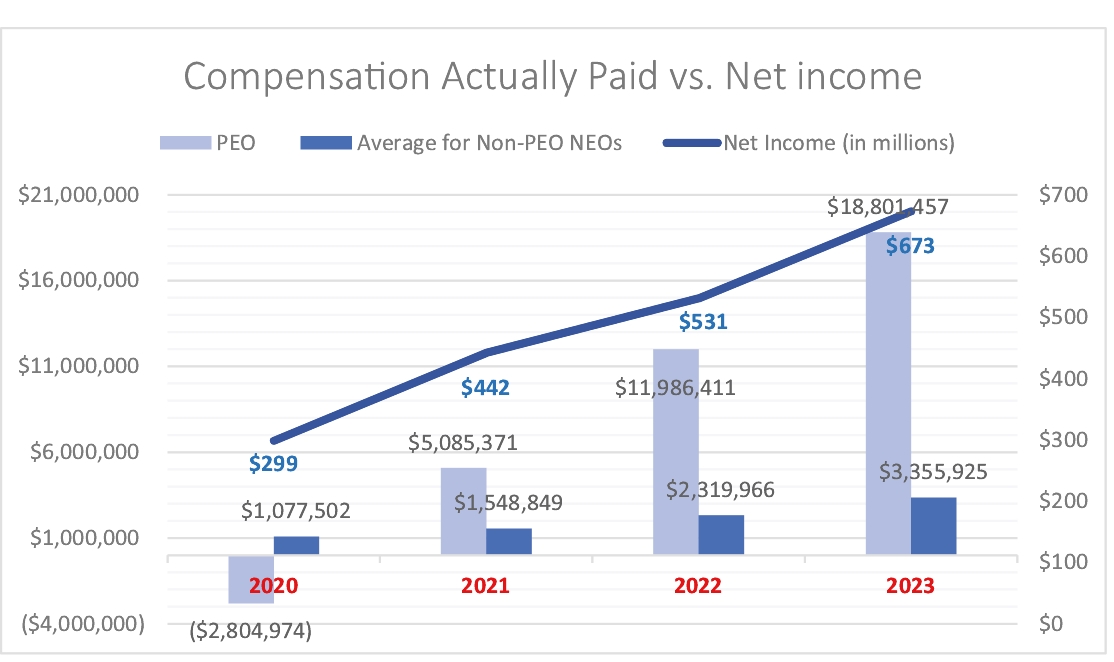

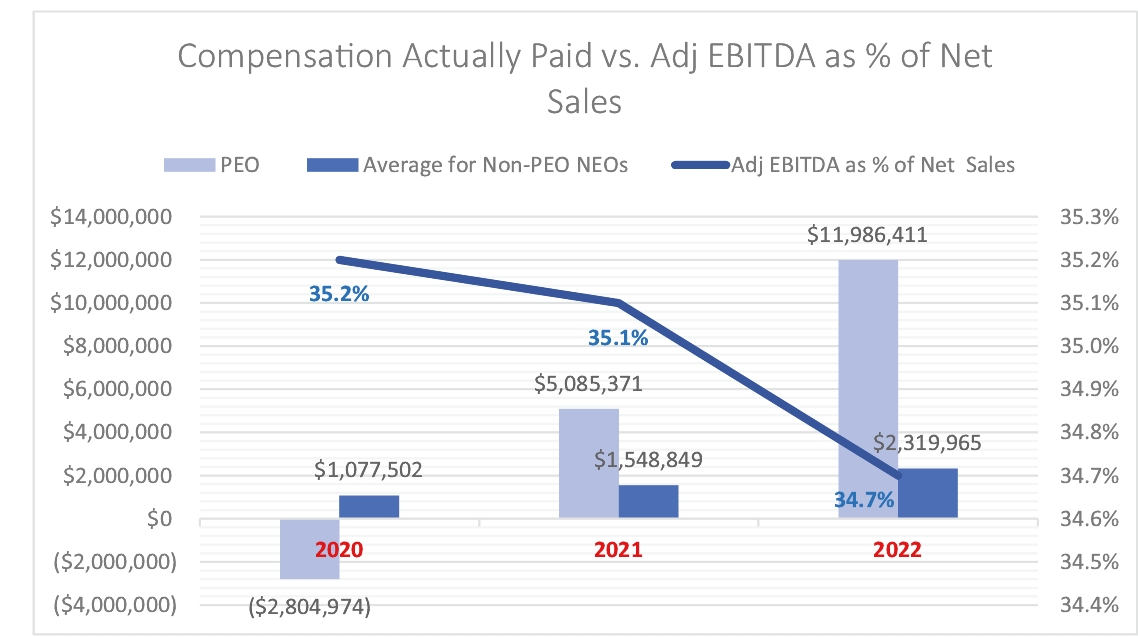

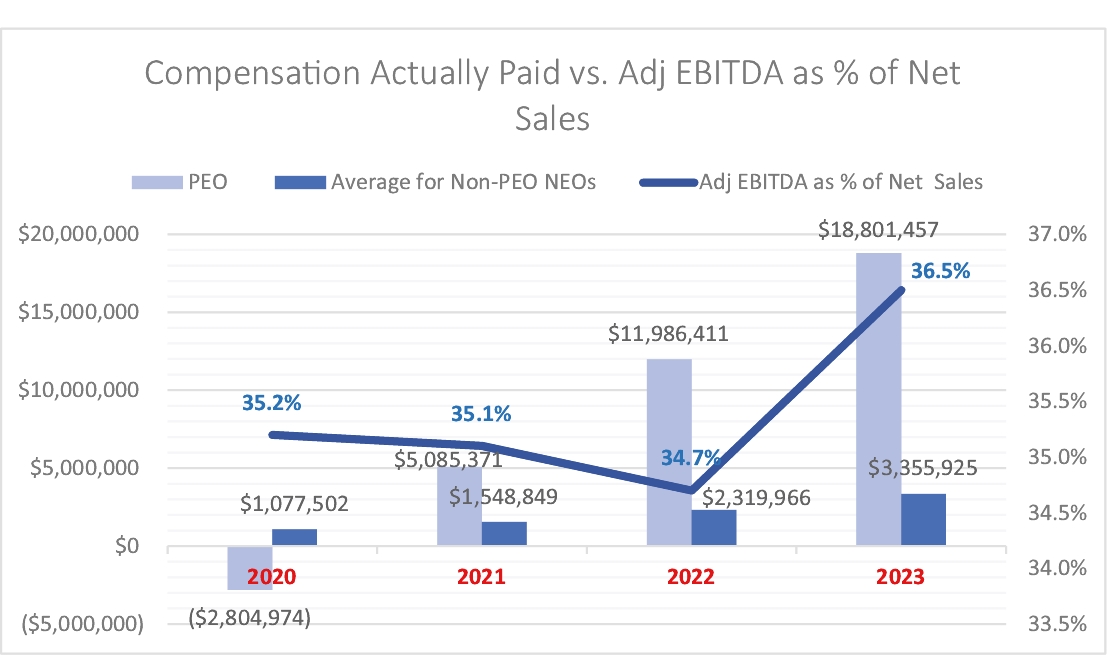

generate Net income of $531 million, Adjusted EBITDA of $961 million and Adjusted EBITDA as a percent of net sales of 34.70%, with Adjusted EBITDA as a percent of net sales exceeding ourGlobal Off-Highway end market, which exceeded the target level of performance for purposes of our annual cash incentive bonus compensation plan, which we refer to as IComp;

delivergenerated Net income of $673 million, Adjusted EBITDA of $1,108 million and Adjusted EBITDA as a percent of net sales of 36.50%, with Adjusted EBITDA as a percent of net sales exceeding our target level of performance for IComp; and

delivered Net cash provided by operating activities of $657$784 million and Adjusted free cash flow of $490$659 million, with Adjusted free cash flow exceeding the target level of performance for IComp; and

achieve Revenue of $2,769 million, experiencing gains in every end market other than the Defense end market, which exceeded the targetmaximum level of performance for IComp.

As a result of these accomplishments, our 20222023 performance was 115.13%121.16% of target for purposes of IComp, resulting in a payout of 190.78%226.97% of target. Adjusted EBITDA, Adjusted EBITDA as a percent of net sales and Adjusted free cash flow are non-GAAP financial measures. For information about how we define these measures and where to find a reconciliation to the most comparable GAAP measures, refer to the discussion below under the heading “—20222023 Compensation Decisions—Annual Performance-Based Compensation.Compensation (IComp).”

In addition, our operational performance allowed us to continue investing in our business while simultaneously returning value to stockholders, as demonstrated by the following actions taken during 2022:2023:

returning capital to stockholders by repurchasing approximately $278$263 million of our shares of common stock, or over 85 percent of our outstanding shares of common stock as of December 31, 2021,2023, and paying approximately $80$83 million in cash dividends to stockholders; and

investing in the ongoing expansion of our technology capabilities, as well as product development focused on value propositions that address challenges, including improved fuel efficiency and reduced emissions.